Markets

Visualizing America’s Shortage of Affordable Homes

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Visualizing America’s Shortage of Affordable Homes

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

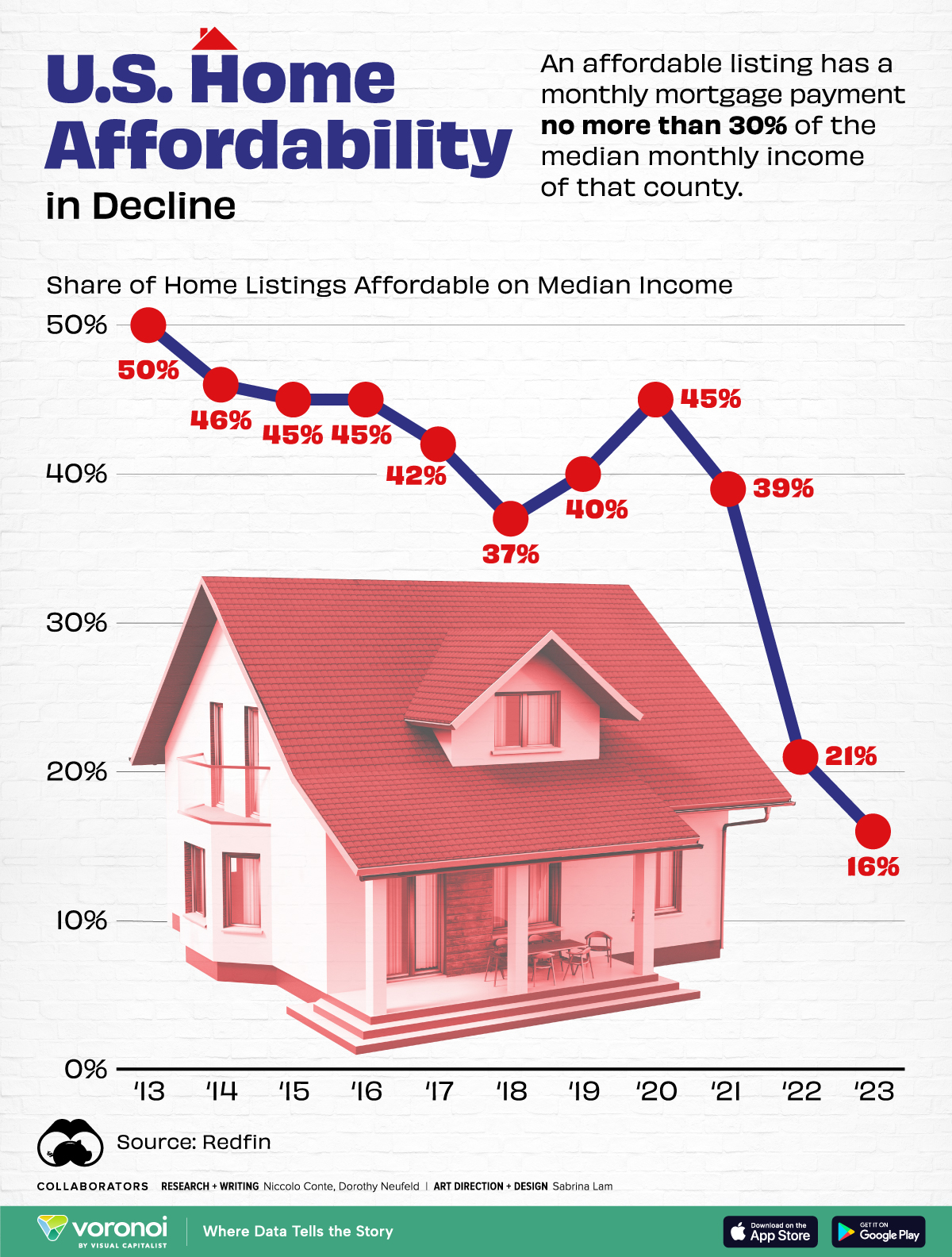

A large share of affordable homes vanished over the pandemic, leading the supply to hit its lowest level on record in 2023.

Many buyers have become priced out of the market due to soaring home prices and high interest rates. Last year alone, the number of affordable homes shrank by almost 41%, equal to over 243,000 properties.

This graphic shows the dwindling supply of affordable U.S. homes, based on data from Redfin.

The Sharp Decline in Housing Affordability

In 2023, only 16% of homes were affordable in America, falling from 21% in the year before.

An affordable listing was defined as one with a monthly mortgage payment no more than 30% of the median monthly income of that county. Below, we show the share of affordable listings in the 97 biggest U.S. metropolitan areas by population:

| Year | Share of Affordable Home Listings | U.S. Median Sale Price on New Home | Average 30-Year Fixed Mortgage Rate |

|---|---|---|---|

| 2023 | 16% | $427,400 | 6.81% |

| 2022 | 21% | $457,800 | 5.34% |

| 2021 | 39% | $397,100 | 2.96% |

| 2020 | 45% | $336,000 | 3.10% |

| 2019 | 40% | $321,500 | 3.94% |

| 2018 | 37% | $326,400 | 4.54% |

| 2017 | 42% | $323,100 | 3.99% |

| 2016 | 45% | $307,800 | 3.65% |

| 2015 | 45% | $294,200 | 3.85% |

| 2014 | 46% | $288,500 | 4.17% |

| 2013 | 50% | $268,900 | 3.98% |

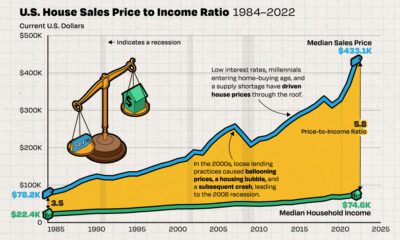

As the above table shows, housing affordability has grown increasingly out of reach as mortgage rates have more than doubled in just two years.

While affordable homes made up 39% of the market in 2021, the share dropped precipitously as interest rates climbed higher. In 2023, the average annual 30-year fixed mortgage rates reached 6.81%—hitting its highest level in 20 years.

Although mortgage rates may decline over the year if the Federal Reserve cuts interest rates, it may not be enough to boost the supply of affordable housing.

That’s because rates may not fall sharply enough to undo the “golden hand-cuff” effect, where homeowners are reluctant to sell in order to hold on to their low mortgage rates. Adding to this, home construction has fallen significantly since the global financial crisis. During this time, home builders and lenders became increasingly cautious, leading home construction to drop 55% between 2006 and 2021.

What Comes Next?

The good news is that new-home construction is forecast to increase in 2024, with single-family housing starts projected to grow 4.7%.

While new home sales have historically comprised 10-12% of the single-family home market, they have recently surged to 30% due to the collapsing supply of existing homes. But even as new supply enters the market, it will likely take a number of years for housing affordability return to historical levels.

In fact, JP Morgan suggests that it could take two years if mortgage rates drop by 1 percentage point, assuming that home prices remained at all-time highs and wages continued rising at their current pace.

Maps

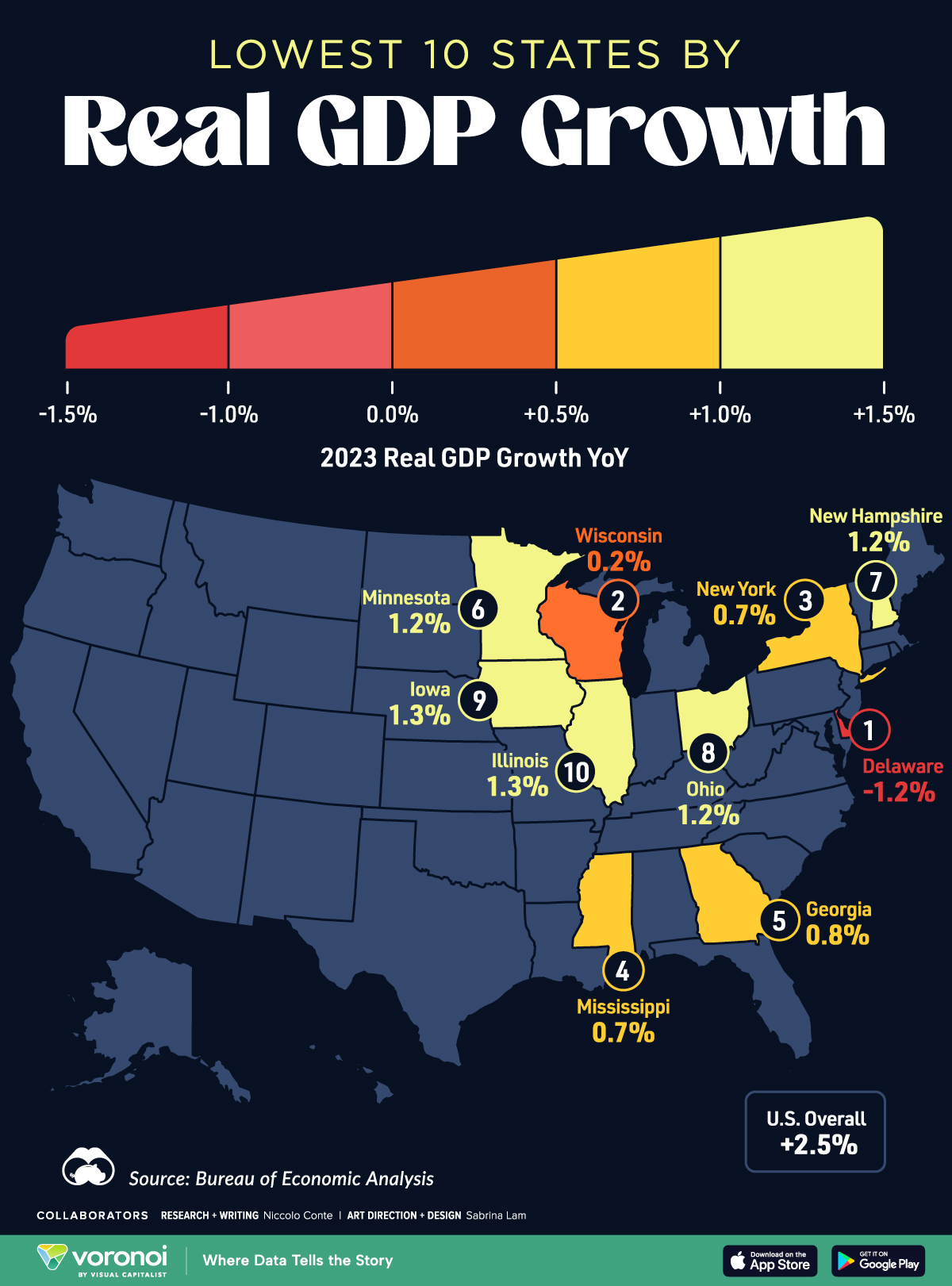

Mapped: The 10 U.S. States With the Lowest Real GDP Growth

In this graphic, we show where real GDP lagged the most across America in 2023 as high interest rates weighed on state economies.

The Top 10 U.S. States, by Lowest Real GDP Growth

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

While the U.S. economy defied expectations in 2023, posting 2.5% in real GDP growth, several states lagged behind.

Last year, oil-producing states led the pack in terms of real GDP growth across America, while the lowest growth was seen in states that were more sensitive to the impact of high interest rates, particularly due to slowdowns in the manufacturing and finance sectors.

This graphic shows the 10 states with the least robust real GDP growth in 2023, based on data from the Bureau of Economic Analysis.

Weakest State Economies in 2023

Below, we show the states with the slowest economic activity in inflation-adjusted terms, using chained 2017 dollars:

| Rank | State | Real GDP Growth 2023 YoY | Real GDP 2023 |

|---|---|---|---|

| 1 | Delaware | -1.2% | $74B |

| 2 | Wisconsin | +0.2% | $337B |

| 3 | New York | +0.7% | $1.8T |

| 4 | Missississippi | +0.7% | $115B |

| 5 | Georgia | +0.8% | $661B |

| 6 | Minnesota | +1.2% | $384B |

| 7 | New Hampshire | +1.2% | $91B |

| 8 | Ohio | +1.2% | $698B |

| 9 | Iowa | +1.3% | $200B |

| 10 | Illinois | +1.3% | $876B |

| U.S. | +2.5% | $22.4T |

Delaware witnessed the slowest growth in the country, with real GDP growth of -1.2% over the year as a sluggish finance and insurance sector dampened the state’s economy.

Like Delaware, the Midwestern state of Wisconsin also experienced declines across the finance and insurance sector, in addition to steep drops in the agriculture and manufacturing industries.

America’s third-biggest economy, New York, grew just 0.7% in 2023, falling far below the U.S. average. High interest rates took a toll on key sectors, with notable slowdowns in the construction and manufacturing sectors. In addition, falling home prices and a weaker job market contributed to slower economic growth.

Meanwhile, Georgia experienced the fifth-lowest real GDP growth rate. In March 2024, Rivian paused plans to build a $5 billion EV factory in Georgia, which was set to be one of the biggest economic development initiatives in the state in history.

These delays are likely to exacerbate setbacks for the state, however, both Kia and Hyundai have made significant investments in the EV industry, which could help boost Georgia’s manufacturing sector looking ahead.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc6 days ago

Misc6 days agoVisualized: Aircraft Carriers by Country

-

Culture6 days ago

Culture6 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country